Download this week’s Patriot

Download this week’s Patriot with the link below: Click to access April-19-2024.pdf

Download this week’s Patriot with the link below: Click to access April-19-2024.pdf

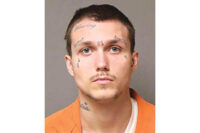

Staff Report A man is being held on a variety of charges including 2nd Degree Murder in the April 2, 2024 death of a Hiwassee man. According to Pulaski County Sheriff Mike Worrell, on Tuesday, April 2 at approximately 8 p.m., the Pulaski County Sheriff’s Office responded to a disturbance […]

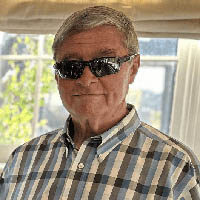

Victor Leneal Matthews, 71, of Radford passed away in the early morning hours on April 9, 2024 at Lewis-Gale Montgomery Hospital after a brief illness. Vic, as he was often called, was born on October 6, 1952 in Radford, Virginia to Irma Jean Matthews Tinner and the late William Robert Matthews. After […]

A Harrisonburg TV station is reporting that former Pulaski County Cougar Matt “Tater” Roan will be hired as the next athletic director at James Madison University. WHSV TV reported Tuesday afternoon that Roan would be the pick to succeed Jeff Bourne, who will retire at the end of the month. […]

Virginia State Police is investigating a two-vehicle crash involving two tractor-trailers that occurred Monday (April 15, 2024) at 9:50 p.m. at the interchange of Interstate 81 northbound and Interstate 77 in Wythe County. One tractor-trailer had parked partially in the emergency lane and partially in the right northbound lane of […]

Donald Rex Jones, Sr., age 87 of Pulaski went home to Jesus Sunday, April 14, 2024 from the New River Valley Medical Center. Born September 9, 1936 in Mississippi, he was the son of the late Bilbo & Virginia Jones. He was also preceded in death by his daughter Robin […]

The National Weather Service has issued a severe thunderstorm watch for Pulaski County and most of Virginia until Monday night at 10 p.m. Only the far southwest tip of the state is outside the watch area.

Mr. Douglas Edgar Hughett, 71, passed away Thursday, April 11, 2024, at his home. He was born in Roanoke, VA on May 2, 1952, to the late Edgar Allen and Nina Ballard Hughett. Mr. Hughett retired from Norfolk Southern Railroad with 39 years of service. He served as the Secretary/Treasurer […]

Virginia State Police is investigating a fatal motorcycle crash that occurred Sunday (April 14, 2024) at 3:00 p.m. on Interstate 77 northbound in Bland County. A 2011 Harley Davidson HARLX1200 was heading northbound on I-77 at the 56-mile marker when it veered off the Interstate to the right and struck […]

Harold Clayton Rupe, age 82 was called home by our heavenly father on Saturday, April 13, 2024 at the Roanoke Memorial Hospital. Harold was preceded in death by his father, Charlie Basil Rupe, his mother Eunice Cecil Rupe Turpin, his wife of 35 years Jewel White Rupe, his first grandson […]

After a long battle with cancer, Karen Dishon Van Curen, age 59 of Clover, South Carolina and formerly of Snowville, Virginia passed away Thursday, April 11, 2024 in her home surrounded by family. Known for her love of people, positive outlook on life and love for vacationing with family and […]