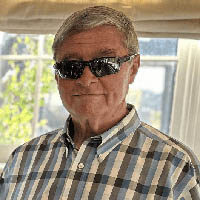

Donald Keith Roberts

Donald Keith Roberts, age 60 of Radford passed away Thursday, April 18, 2024 at his home surrounded by family. Born May 26, 1963 in Bluefield, West Virginia he was the son of Don Arnold Roberts and the late Carrie Margaret Roark Roberts. He was also preceded in death by his […]