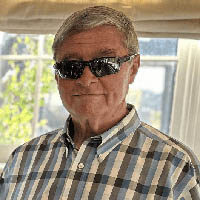

Donald Rex Jones, Sr.

Donald Rex Jones, Sr., age 87 of Pulaski went home to Jesus Sunday, April 14, 2024 from the New River Valley Medical Center. Born September 9, 1936 in Mississippi, he was the son of the late Bilbo & Virginia Jones. He was also preceded in death by his daughter Robin […]